The IBA Group’s tapXphone Solution to Serve More Clients in Ukraine

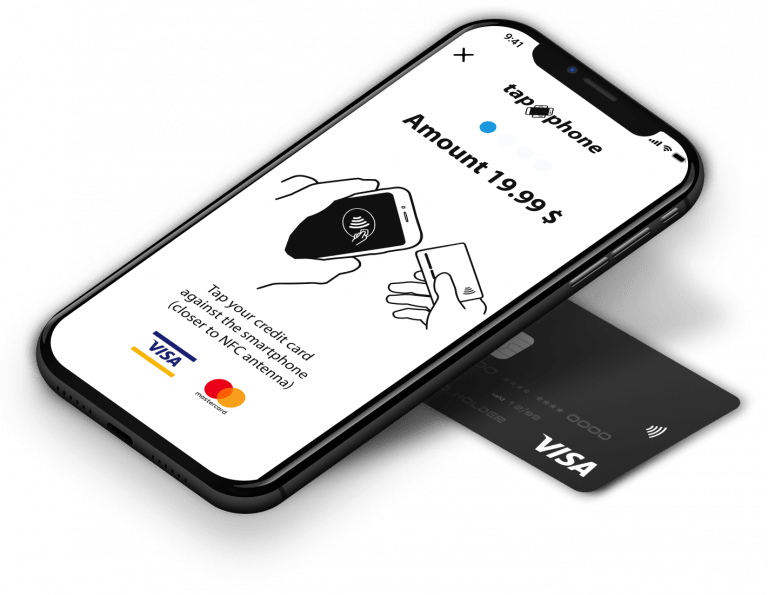

IBA Group implemented the tapXphone solution for ConcordBank and the Portmone payment platform. The solution turns a regular smartphone into a payment terminal. TapXphone is an IBA Group’s contactless payment solution certified by Visa.

For Central and Eastern Europe, the Middle East, and Africa, this is one of the first projects launched jointly by a bank and a non-bank payment platform.

To set up a service, a user needs only the Internet and can start using it a few hours after the signup. The registration procedure consists of the following three steps:

- Remote identification

- Signing a contract online

- Installing a mobile application

The system accepts payments regardless of the bank where the entrepreneur has a current account.

The IBA’s tapXphone payment solution became the basis of the Pos Phone mobile application, installed on sellers’ smartphones. Customers can pay for purchases and services using a contactless bankcard or an NFC-enabled device. The solution saves entrepreneurs time and money previously spent on purchasing and maintaining costly payment processing hardware.

Entrepreneurs, delivery and other consumer services, and event organizers had a chance to see the advantages of using a smartphone as a payment terminal.

The system requires entering a PIN code if the purchase sum exceeds the established limit. The PIN on Glass technology secures the PIN entry feature, as a shop assistant cannot see the PIN being entered. The digits on the screen are displayed in a different sequence for each transaction.

For IBA Group, this is not the first project on the Ukrainian market. In 2019, IBA Group implemented a tapXphone payment solution for Oschadbank, one of the largest banks in the country. The company plans to launch tapXphone projects for other banks of Ukraine in the near future.

The tapXphone geography also includes Kazakhstan (Kazpost), Moldova (Victoriabank), and Slovakia (Tatra banka). By the end of 2021, IBA Group intends to deploy the payment solution at a number of major European banks.